Equipping investors with data science tools

Unlocking the power of data science

Investment Approach

Investing flexibly and opportunistically across capital structures, sectors and asset classes. Data science is embedded in the investment process from day one.

Thematic, Multi-Sector Scope

Focused on capital markets, demographic, macro-economic and behavioral themes to identify relative-value opportunities across real estate asset classes.

Opportunistic Strategy

Identify asymmetric risk-return investment hypotheses and idiosyncratic, asset-specific opportunities to generate alpha through asset selection, portfolio optimization and business plan execution.

Data Science-Supported Process

Using data science tools to identify target markets, test hypotheses and uncover investment insights ranging from macro to micro.

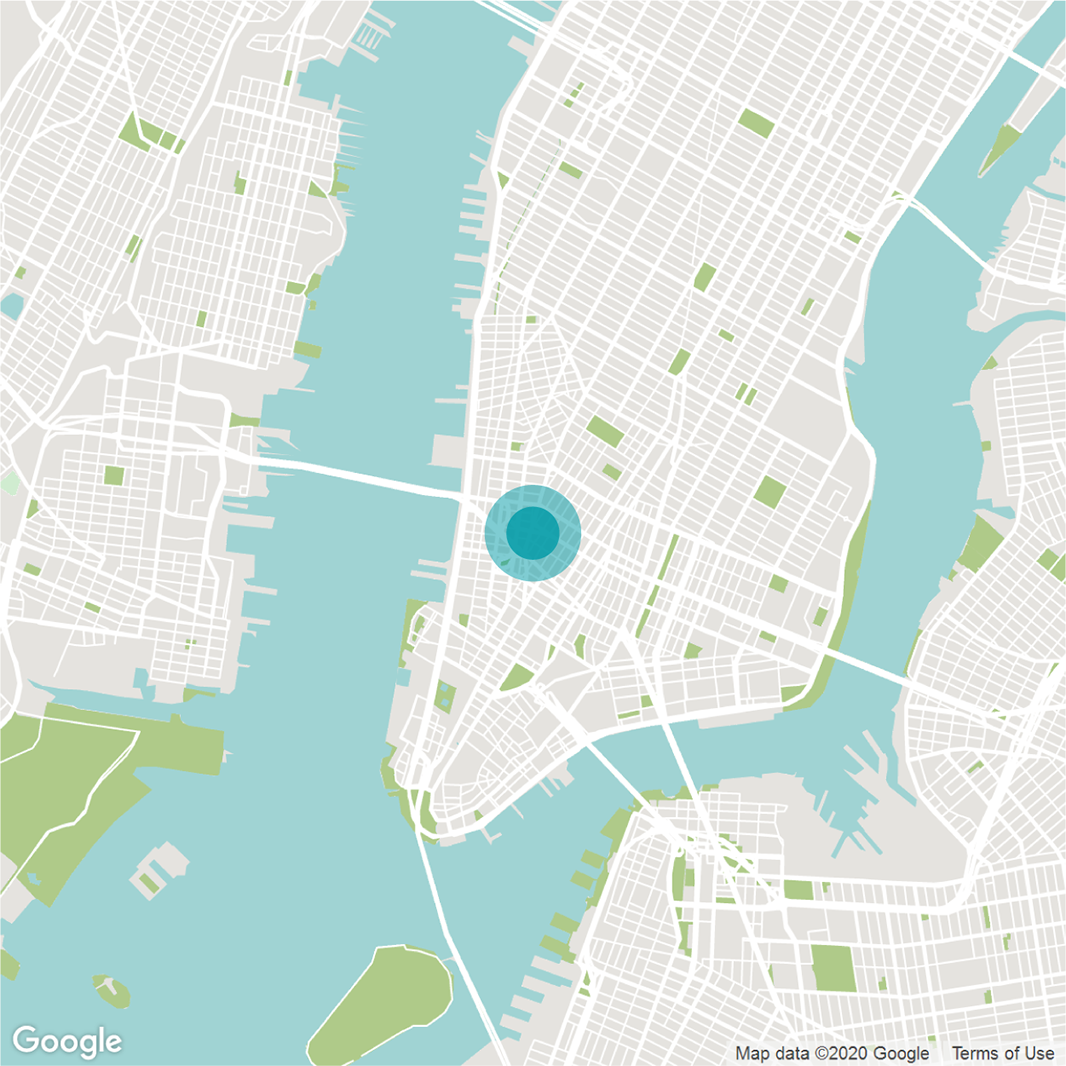

North America Focus

Invest primarily in private markets and selectively in public markets to capitalize on dislocations.

Technology Enabled

Building technology that continuously learns and refines insights through the introduction of new data and observed outcomes and is rigorously back-tested before being used by investment professionals.

Collaborative Capital Solutions Partner

Selectively partner with best in class operators with a long-term mindset bringing the power of the team's deep operational expertise and data science platform to each relationship.

Our Team

-

People

Two Sigma’s ~1,700 employees include 250+ PhDs amongst more than 1,000+ data scientists, engineers and other technical professionals working collaboratively to create alpha through systematic identification of value opportunities.

-

Data

Two Sigma’s diverse and expanding library of structured and unstructured information—from 10,000+ data sources—is housed in a proprietary data management system.

-

Technology

Computing power that would rank in the world’s top 5 supercomputer sites, uses 380+ PB of storage capacity and infrastructure to run over 48,000 simulations daily.

Our Office

Based in New York, we invest across North America.