The economic relationship between the US and China, its top trading partner,¹ has come under increasing strain since mid-2017, when President Trump began taking steps to impose significant tariffs on Chinese imports.

As of this writing, the US was in the process of placing 25% tariffs on $50 billion worth of Chinese goods, to which China has responded with similar measures. More tariffs may be on the way; the US Trade Representative Office produced a list of $200 billion worth of Chinese goods in July that could be subject to an additional 25% duty,² prompting China again to threaten further retaliation.

Although the trade war has likely contributed to a bear market for Chinese equities this year, reactions in US equity markets have been sanguine thus far. This is not too surprising, since the tariffs now in effect are modest relative to the roughly $500 billion worth of goods the US imports from China annually.³ Still, for US companies with exposure to China trade, the ongoing dispute may pose risks, especially if the mooted tariffs on $200 billion of additional goods come into effect. Seeking to quantify those risks, we constructed a China trade sensitivity factor and examined how the factor responded to developments in the evolving conflict.

Building a china trade sensitivity risk factor

We began by gathering a list of US companies that appear likely to be affected by rising trade tensions with China, whether through supply chain interruptions or potential loss of revenue. These companies have either a sizeable proportion of assets (especially manufacturing assets) located in China or a sizeable share of revenue in China disclosed in their 10-K annual report filings. We compiled the list from three baskets of stocks provided by sell-side bank research reports.⁴

Together, these baskets represented 93 publicly traded US companies which have significant exposure to “China trade” risk. To turn this basket of stocks into a risk factor with daily returns, we started with MSCI Barra’s existing US Total Market Equity risk model and augmented it with the new basket of stocks. Next, we performed cross-sectional regressions on daily returns across 3,700+ of the most liquid US equities to seek to identify the unique daily price changes of stocks in the “China trade” basket, after controlling for their individual industry and style risk exposures.

Tracking the impact of trade-related news events

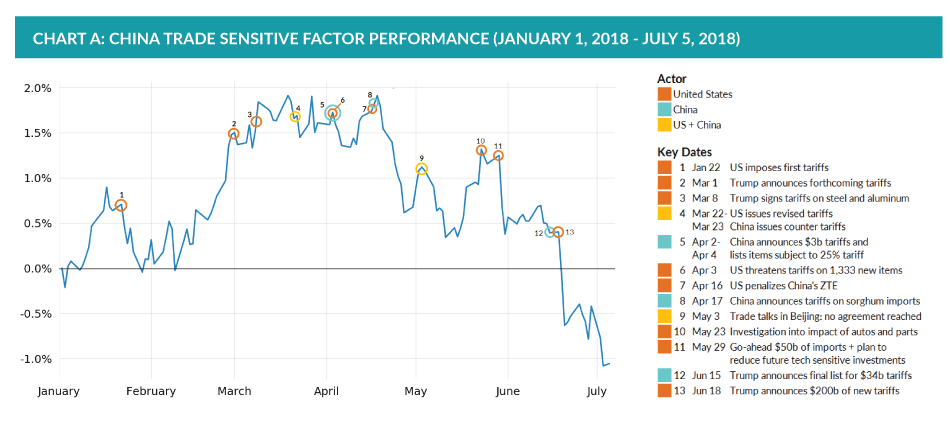

A chart of the China trade sensitivity factor shows that trade-related announcements often precede a drop in the factor’s performance (chart A). For example, on May 29th, after the US committed to $50 billion worth of tariffs on imports and announced its intention to curb investment in sensitive technology, the factor dropped over 50% (event 13, chart A).

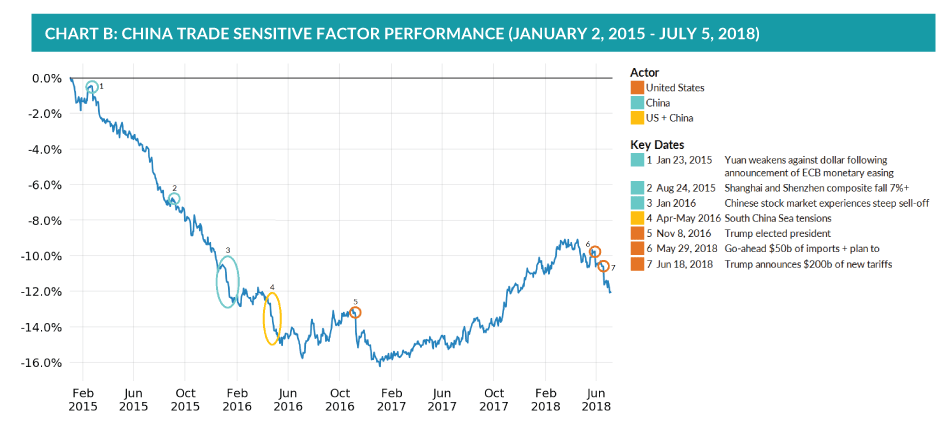

Looking at a longer horizon shows that the China trade sensitive factor steadily decreased from the beginning of 2015 to mid-2016 before leveling out for about a year (chart B). It was during the 2015-2016 period that there were concerns with China’s economic slowdown and stock market turbulence. Perhaps counter-intuitively, given the degree of media coverage of the trade wars, the risk of economic slowdown a few years back appears to have had nearly an order of magnitude greater impact on China-sensitive US equities than the current trade war concerns.

Measuring the explanatory power of the factor

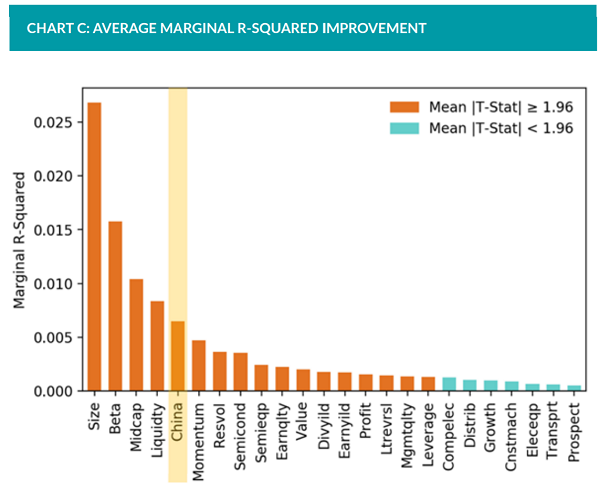

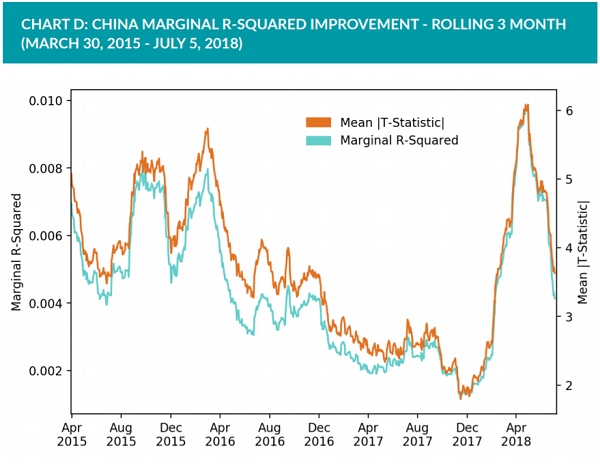

Seeking to measure the explanatory power of the China trade sensitive factor, we calculated the improvement in r-squared from including the China factor in a cross-sectional regression. To provide context for our results, we also ran the same analysis for all Barra style factors and seven industry factors to which the China basket has particular exposure.5 We found that including the China factor improved the r-squared by 0.0065 on average; compared to the other factors, the China trade sensitive factor had the fifth greatest marginal r-squared improvement (chart C).

Looking at the change in explanatory power over time, we see that it roughly matches our intuition for when news about trade disputes or Chinese economic growth roiled markets the most (chart D). When Chinese growth and local stock markets grew volatile in 2015, the factor appears quite relevant. Then it quieted down and appeared to be a minor factor from later 2016 into 2017, before resurging with the recent series of trade concerns. Over time, it seems reasonable to expect this factor will continue to wax and wane in importance for US equities with the flow of news on Chinese economic growth and trade relations between the two countries.

Appendix

| Date | Event |

| 1/23/2015 | Chinese yuan opens sharply weaker after the European Central Bank unveils aggressive monetary easing program. The People’s Bank of China lowers the yuan’s daily reference rate against the U.S. dollar by the most since March 2014. |

| 8/24/2015 | Main Shanghai share index drops 8.5% (steepest one-day drop in eight years) and the main Shenzhen index fell 7% |

| 1/2016 | From January 4-15, China’s stock market falls 18% (the Dow Jones Industrial Average was down 8.2%). |

| 3-4/2016 | Increased tensions between China and the US over the status of the South China Sea. |

| 11/8/2016 | Donald Trump is elected president of the United States (N.B. event occurred after market trading hours, so impact of event would be seen the following day). |

| 1/22/2018 | Trump announces tariffs on washing machine and solar cell imports. |

| 3/1/2018 | Trump announces forthcoming tariffs on all trading partners of 25% on steel and 10 % on aluminum. |

| 3/8/2018 | Trump signs tariffs on imported steel and aluminum from all nations, including China. |

| 3/22/2018 | Section 301 investigation on Chinese imports publicly released. US proposes tariffs in response to China’s “unfair trade practices” related to technology transfer, IP, and innovation; says it will complain to WTO and look at restricting investment from China. |

| 3/23/2018 | Steel and aluminum tariffs go into effect. |

| 3/23/2018 | China unveils tariffs on $3 billion of US imports in response to steel and aluminum tariffs. |

| 4/2/2018 | China announces tariffs on $3 billion of US imports including fresh fruits, nuts, wine, aluminum, and pork. |

| 4/3/2018 | The Trump administration releases its list of 1,333 Chinese products under consideration for 25% tariffs, which cover $46.2 billion of US imports. |

| 4/4/2018 | China complains to WTO about the Section 301 tariff action by the US. |

| 4/4/2018 | China responds to Trump’s Section 301 tariffs, publishing list of 106 products subject to forthcoming 25% tariffs, covering $49.8 billion of China’s imports. |

| 4/16/2018 | US penalizes China’s ZTE for violating a previous agreement by conducting business with Iran and North Korea. ZTE is banned from buying US technology for seven years. |

| 4/17/2018 | China announces it will collect anti-dumping tariffs on sorghum imports from the US. |

| 5/3/2018 | US-China trade talks in Beijing. No agreement is reached. |

| 5/23/2018 | The Commerce Department initiates another national security investigation into imported autos and parts, the third such investigation under Trump, following the steel and aluminum cases. Public hearings are scheduled for July 19–20, 2018. |

| 5/29/2018 | US announces that it’s moving ahead with tariffs on about $50 billion of imports (announced 4/3-4/2018) and a plan to curb investment in sensitive technology. |

| 5/29/2018 | US announces plan to limit some visas for Chinese citizens to protect intellectual property. |

| 6/15/2018 | US announces final product list for first $34b of tariffs (see 4/3-4/18 and 5/29/18). Additional $16b will be finalized at later date. China responds by issuing an updated retaliation list of 25% tariffs targeting nearly $45 billion worth of US exports. China also plans a two-phase approach, covering $29.6 billion of US goods starting 7/6/18, and the remaining $15.3 billion of products to be announced at a later date. |

| 6/18/2018 | In response to China’s retaliatory tariffs (June 15, 2018), Trump directs the US Trade Representative to identify an additional $200 billion worth of Chinese goods for additional tariffs. Trump also threatens a further $200 billion of tariffs if China retaliates again. |