A second California appeals court ruled on December 30, 2016 that the state can reduce or eliminate pension benefits as long as employees still receive a pension that is “substantial” and “reasonable.”¹ This ruling capped off a tough 2016 for CalPERS members, the largest public pension fund in the United States. CalPERS saw its funded status fall four percentage points to 69 percent. At the same time, CalPERS reduced its assumed investment rate of return from 7.5 percent to 7 percent. Given CalPERS’ ten-year annualized return of 5.1 percent, however, even this return assumption may prove overly optimistic.²

Evaluating what constitutes “substantial” and “reasonable” pension benefits remains a topic squarely in the public policy realm and outside the scope of this market commentary. However, data describing pension plan expectations, performance, and allocations may offer insights to market participants trying to tackle the hard problem of asset allocation.

The Public Plans Data (PPD) produced by the Center for Retirement Research at Boston College³ contains detailed annual data spanning from fiscal year 2001 to 2015 for CalPERS and other large US state and local pension funds. The sample includes 160 plans, which collectively account for approximately 95 percent of the public pension assets and members in the US. An analysis of the data highlights two interesting findings. First, the average public pension plan reports a long-term return expectation of 7.6 percent as of 2015 (the last year available), a forecast that has declined approximately 40 basis points since 2001. Second, pension plans seem to expect to earn ten percent per year from equities over the long term but little to no return from their fixed income and alternatives investments. Other asset owners might have reason to doubt these forecasts. Those who oversee state pension plans, for example, may have an incentive to proffer optimistic forecasts, most of which have not matched the reality of the past five and ten years.

Average public pension plan reports a long-term return expectation of 7.6 percent

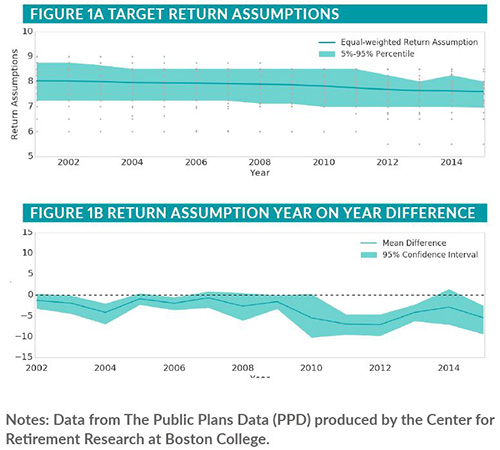

The 160 public pension plans in the data set report a wide range of expected long-term returns. For 2015, the most optimistic plans expected a nine percent return, and the most conservative plans forecasted less than six percent return. Figure 1a reports the time series of these scattered assumptions.

Across all plans in the data, the average return assumptions of pensions has declined from 8.02 percent in 2001 to 7.60 percent in 2015⁴. The decline in the average reflects small changes across most individual plans since 2008 (Figure 1b), not large changes for only a few plans. The average change differs statistically from zero for most years following the financial crisis, but only by five basis points per year. Since 2001, the average annualized return for these plans was approximately 5.7 percent.⁵

Public pension plans assume approximately ten percent returns from equities and little to no returns from fixed income over the long-term

Identifying where pension plans expect to generate these returns requires some algebra. If most plans operate with a mean-variance utility framework, it is relatively straightforward to calculate their implied asset-class return expectations given their portfolio-level return and volatility expectations, asset-class allocations, and historical asset-class volatility and covariance (see technical appendix for details).

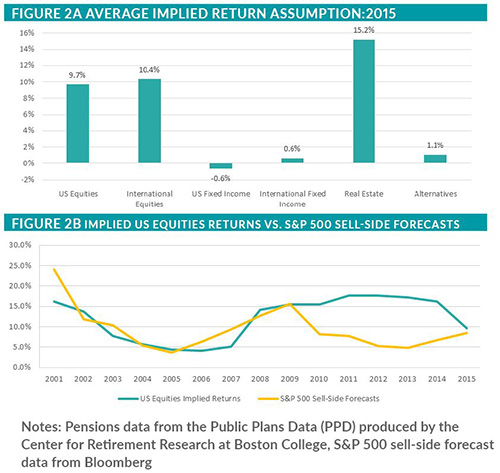

For example, during 2015 CalPERS assumed a 7.5 percent annualized return and a 13.0 percent target volatility.⁶ CalPERS allocated approximately 24 percent to US equities.⁷ Based on the long-term covariance across asset classes, this suggests CalPERS implied US equity returns equal 10.3 percent (see appendix in the pdf version of this article for details).⁸

Figure 2a reports these implied asset class returns across the cross-section of pension funds based on their fiscal year 2015 allocations. On average, the implied returns suggest an approximately ten percent return to equities (US and international) and fifteen percent to real estate. The implied expectation for fixed income returns is approximately zero. Return expectations for alternatives also remain low. This may be a reason why several pensions announced their decision to cut their hedge fund allocations.⁹

Whether these return expectations prove realistic remains an open question. Figure 2b compares US equity implied returns with published S&P forecasts from leading sell-side banks.10 From 2010 to 2014, a chasm of more than five percentage points separated the expectations of pension plans and banks. It seems that public pension funds did not adjust their allocations to US equities to account for the higher volatility following the financial crisis, leading to significantly higher implied returns from US equities compared to sell-side analysts’ forecasts. Since 2014, that gap has narrowed and fallen more in line with sell-side forecasts.

Potential implications

At first glance, lofty investment return assumptions may seem unreasonably optimistic, but pension plans have a potential rationale. Certain accounting rules for public pensions foster optimism, because public pensions discount their liabilities based on their assumed rate of return instead of an appropriate-duration credit rate.11 This potentially encourages pensions to report high return assumptions, even while the markets may not reflect the same beliefs. When CalPERS cut its long-term forecast to seven percent, it phased in its official forecast over the next three years. One might wonder whether that implies a higher degree of confidence in generating returns for 2017 and 2018 than in subsequent years.

Looking at pension performance through an actuarial lens reflects a grimmer outlook. The Public Plans Data indicates that the average funded ratio across pension funds has declined from 99 percent in 2001 to 74 percent in 2015.12 During this period, the average year-over-over growth in liabilities of 5.5 percent across public pension funds outpaced the average growth in assets of 3.2 percent.

Without meeting their target returns or additional funding, pension funds will not keep pace with their liability growth rates, posing potential hazards to employee benefits and potentially straining government budgets in the future. In January, CalPERS benefitted from an additional $5.3 billion contribution from the state of California, an increase of 11 percent from last year.13 Other funds may not be as lucky.

A version of this Street View appeared in Pensions & Investments (login required) in March 2016.