Recent market volatility has been a reminder to market participants that complacency can be hazardous. Risk can rear its ugly head at any moment—and seemingly come from anywhere. Among the most frequently cited sources underlying recent market ructions have been the potential return of inflation and rising interest rates amid prospective monetary tightening and fiscal easing.

Recent issues of Street View have explored ways to identify and quantify not only inflation, but additional sources of potential risk, as well, including policy-related uncertainty and other “unconventional” risks like geopolitical uncertainty. Against this background, it’s worth examining still another source of risk, one that’s primed to elicit greater attention in the coming weeks: trade—specifically as it pertains to NAFTA negotiations.

For months, the US, Canada, and Mexico have been working to update the landmark 1994 trade agreement along a variety of different dimensions. With both Mexico and Canada opposed to some of the US’s key demands (and vice versa), the talks have not gone smoothly. Trade representatives have extended the negotiating timeframe twice already, with the next round of negotiations slated to take place from February 26 to March 6.

While it’s impossible to predict either the talks’ short-term or final outcomes, a broad re-writing of trilateral terms of trade appears likely, and a breakup of NAFTA, though perhaps less probable, is certainly a possibility. At the very least, further uncertainty seems a given.

What do financial markets tell us about the state of NAFTA talks?

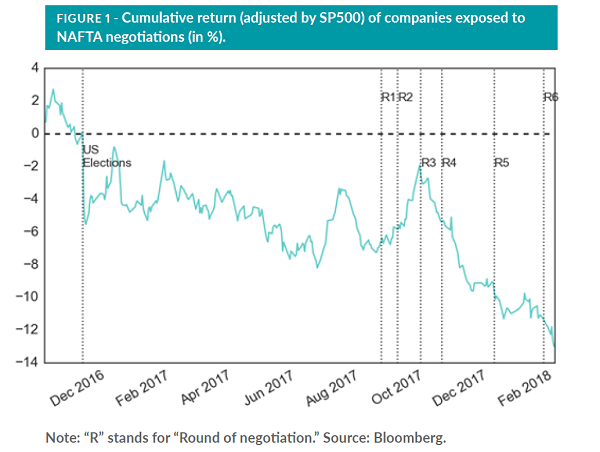

Financial markets have taken notice of the challenges negotiators face making headway toward a deal that would benefit all sides. As Figure 1 shows, an index¹ of shares of predominantly North American companies with relatively high exposure to NAFTA (adjusted for the performance of the S&P 500 Index)² has been declining dramatically as renegotiation talks have dragged on. For the moment, at least, financial markets appear to be taking a dim view of the ultimate effects of a NAFTA 2.0.

Although the companies in the index add up to only about 5% of the overall size of the S&P 500, their combined market capitalization is still roughly $1.2 trillion, with high concentrations of consumer staples, consumer discretionary, industrial, and materials firms.

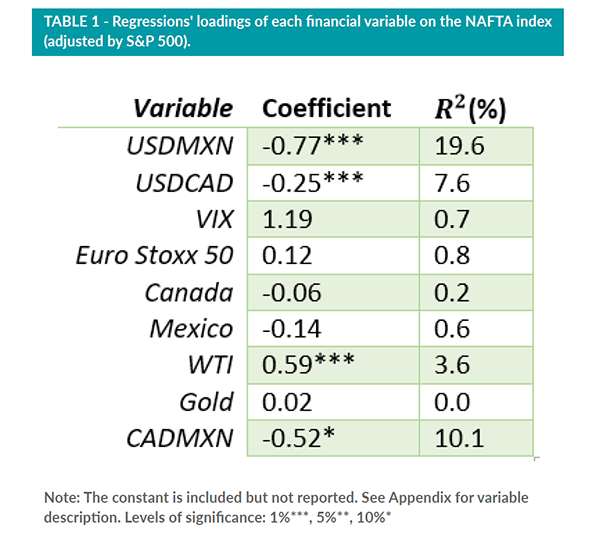

Regressing the performance of this index since October 2016 against that of local and global financial variables shows a pronounced, contemporaneous correlation mainly with currencies (Table 1). Indeed, the epicenter of uncertainty surrounding NAFTA negotiations appears to be the USD/MXN exchange rate. Since October 2016, a 10% decline in the index has corresponded with a 7.7% and 2.5% drop in the value of the peso and Canadian dollar versus the US dollar, respectively.

Economic risks greatest for Canada and Mexico

The simple analysis in Table 1 suggests that the market impacts surrounding the NAFTA agreement are mostly confined to the three North American economies—for now, at least (the Euro Stoxx 50 Index of Eurozone-domiciled companies, for example, shows very little correlation).³ Additionally, the NAFTA negotiations seem to affect the performance of WTI crude prices, as shown by the positive loading. Indeed, as reported by MIT’s Observatory of Economic Complexity⁴, Mexico and Canada export about 48 and 98% of their internal production of crude petroleum to the United States.

Potential implications for investors

Recent weeks have demonstrated how quickly sanguine financial markets can turn unstable. And while inflation, monetary policy, and fiscal policy have been dominating headlines, allocators and other market participants should not ignore other, less frequently noted sources of uncertainty, including trade.